Powering the Trucking Industry with Smart Software & Financial SolutionS

At Firstgates LLC, we build technology that drives the future of transportation. Specializing in custom software development, platform integration, and accounting services, we help trucking companies simplify operations, ensure compliance, and gain full financial control.

From ELD and HOS management systems to IFTA reporting, bookkeeping, and tax filing — our solutions are designed for the road ahead. Whether you're scaling your fleet or optimizing back-office operations, Firstgates is your strategic partner for growth and innovation in the trucking industry.

Our Benefit

At Firstgates LLC, we provide integrated solutions that bring clarity, compliance, and control to the trucking industry. Our expertise spans technology, safety, and finance — empowering your business to operate smarter and grow faster.

Streamlined Operations

Our digital platforms and ELD tools simplify fleet management, automate compliance, and reduce operational friction — so you can focus on the road ahead.

Trusted Accuracy

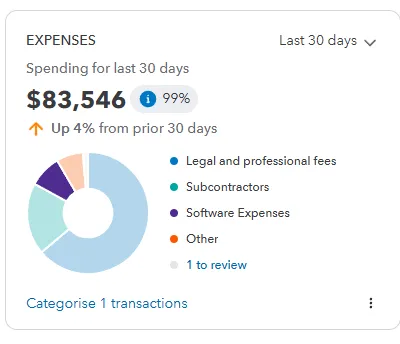

We deliver precise accounting, IFTA reporting, and tax filing services tailored to the transportation sector, ensuring compliance and financial peace of mind.

Scalable Solutions

From startups to established carriers, our flexible services and custom-built software evolve with your business — helping you achieve sustainable, long-term success.

Who We Are

We Build Smart Solutions for Trucking & Finance

At Firstgates LLC, we started our journey in 2016, just as the trucking industry began embracing digital transformation. From day one, we’ve been focused on developing tailored software solutions designed around our clients’ real-world needs — helping them stay compliant, efficient, and financially secure.

With years of experience in both technology development and accounting for transportation businesses, we’ve become a trusted partner for carriers, fleet operators, and logistics service providers across the U.S.

Custom Software for the Trucking Industry

Reliable Compliance & Financial Services

Client-Centric Development Approach

20+

Team Members • U.S. & International Reach

Smart Operational Tools

Our solutions help carriers streamline dispatch, driver logs, and safety management. With advanced platforms tailored to FMCSA standards, we ensure your business runs efficiently and stays compliant.

Fair & Transparent Pricing

We offer competitive pricing on all services — from ELD platform subscriptions to monthly accounting packages. Our goal is to provide maximum value without hidden fees, helping you grow without financial pressure.

24/7 Industry Support

Our dedicated team of specialists is available around the clock. Whether you need help with software setup, compliance issues, or financial reporting, Firstgates is here whenever you need us.

What Client Say

Here's what our clients have to say about working with Firstgates LLC

and the impact our solutions have had on their trucking businesses:

The team at Firstgates helped us automate our driver log review and compliance checks — now we save hours each week and pass audits with confidence.

James Smith

Fleet Compliance Manager

Since switching to Firstgates for accounting, our IFTA reports and tax filings are always on time and error-free. They know trucking inside out.

Rachel Lee

Operations Director

Their custom ELD platform and 24/7 support made onboarding our fleet a breeze. The peace of mind is unmatched.

Michael Chen

Logistics Coordinator

Frequently Asked Questions

What services does Firstgates LLC provide?

We specialize in software development, compliance platforms, and accounting services for the trucking industry. Our offerings include ELD systems, driver HOS monitoring, IFTA fuel tax reporting, bookkeeping, payroll, and tax preparation.

How do I know which services my trucking company needs?

Our team offers a free initial consultation to evaluate your business structure, fleet size, and compliance needs. Based on this, we recommend a tailored service package that aligns with your goals and DOT requirements.

What is the cost of your services?

We provide flexible and competitive pricing based on the services you choose. Whether it’s monthly accounting or full platform integration, we offer scalable packages for startups and established carriers.

How do I get support or request changes to my service?

You can contact our support team 24/7 via email, phone, or live chat. We also provide client dashboards for real-time updates, status reports, and direct communication with your assigned advisor.

What documents do I need to provide for tax preparation?

You’ll need to submit business income/expense records, fuel receipts, mileage logs, prior-year returns (if applicable), and company formation documents. We provide a checklist to simplify the process.

Do you offer year-round tax advisory and planning?

Yes, we offer ongoing tax advisory services to help you plan ahead, reduce liabilities, and stay compliant with federal and state regulations — not just during filing season.

I’m a non-resident operating a U.S. trucking company. Can you file taxes for me?

Yes, we specialize in assisting non-residents and international owners of U.S. trucking companies. We file Forms 1040NR, 1120, and 5471, and help structure your finances for tax efficiency and compliance with IRS regulations.

Can you help me file Form 2290 for heavy vehicles?

Absolutely. We prepare and file Form 2290 for heavy vehicle use tax, including electronic filing (e-File) and delivery of the IRS-stamped Schedule 1. We also offer deadline reminders and renewal tracking.

Do you handle IFTA filings for multiple states?

Yes. We handle multi-state IFTA tax preparation and filing based on your mileage and fuel purchases. We also provide fuel tracking tools and audit support if needed.

Your trusted partner in financial growth and investment success, committed to securing your financial future.

Quick Links

Home

About Us

Services

Useful Links

Testimonials

FAQs

Blog